RNH was represented at the Mont Pelerin Society regional meeting in Lima, Peru, 22–25 March 2015 by Professor Hannes H. Gissurarson, a MPS member since 1984. Professor Gissurarson organised, with Professor Harold Demsetz, a MPS regional meeting in Iceland in 2005. The 2015 Lima meeting was devoted to “Liberty: Theory and Practice”. The keynote speaker at the opening ceremony was Peruvian writer Mario Vargas Llosa, the 2010 Nobel Laureate in literature and a MPS member. Vargas Llosa said that classical liberalism was for him grounded on tolerance, the awareness of human fallibility. The MPS President, Professor Pedro Schwartz from Spain, argued in his address to the meeting that the objective of liberals should be freedom of opportunity, not the equality of opportunity. Lecturers at the meeting included Professor Arnold Harberger from the US and Professor Rolf Lüders from Chile, who both analysed the success of the Chilean economic reforms in the late 1970s and early 1980s. Many other distinguished men of letters participated in the meeting. Chilean writer and philosopher Arturo Fontaine discussed the prospects of Chile and the battle of ideas in Latin America. Flemming Rose, editor of Danish daily Jyllandsposten, spoke in defence of press freedom: he has received death threats from muslim fanatics because of cartoons published in his newspaper. Professor Gissurarson participated in a discussion group on natural resources and property rights, where he explained the workings of the Icelandic system of ITQs, Individual Transferable Quotas, in the fisheries. The meeting was ably organised by Peruvian lawyer and writer Professor Enrique Ghersi. The next meeting of the Mont Pelerin Society will be the 2016 general meeting in Miami, Florida.

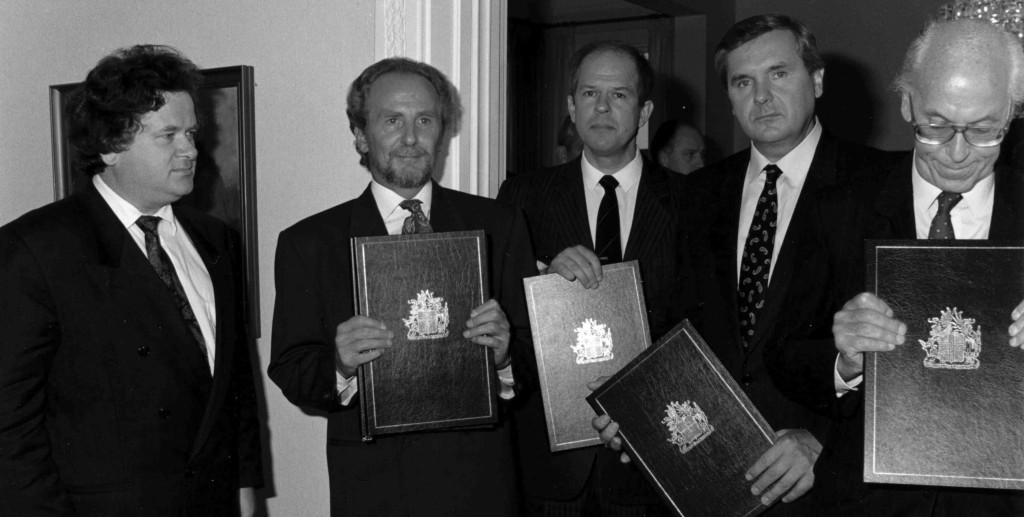

Tabula Gratulatoria – Ragnar Árnason

Coming Up

Research Areas

Roots

Blogs

Archives

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- May 2025

- March 2025

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- November 2023

- September 2023

- June 2023

- May 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- June 2021

- April 2021

- March 2021

- December 2020

- July 2020

- January 2020

- December 2019

- November 2019

- September 2019

- August 2019

- June 2019

- May 2019

- April 2019

- March 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- April 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- February 2012

- November 2011

- August 2009

-

Icelandic Research Centre on Innovation and Economic Growth

Fákafeni 11

108 Reykjavík

Sími 615 11 22RNH á YouTube